Episode 5: How Can Banks Work For Me?

..Banks.

They might be behemoth buildings at the business districts of your city, or the local outlet in your town, or even the text-heavy, brightly-colored websites shoving numbers and jargon in your face. They also might be the place safeguarding your money, providing you a lifeline, and the thing that keep economies turning!

Banks often get a bad reputation (not always entirely unearned) and are antagonized by consumers like us. But they are actually the financial backbone of economies and actually support much of the complex economic heavy-lifting that keeps everything functional. For you, they are the financial infrastructure you need to manage your money safely - the roads and bridges you can use to drive yourself to your financial future.

Banks are financial institutions that help manage the flow of money in an economy. They do that by acting as a very complex portal of borrowing and lending. Basically, when you store your money in a bank, you're not just putting it in a locker and letting it go. Instead, the bank will pool your money with that of everyone else that has an account with their bank, and use it to give loans to others (sometimes also to you). In the meantime, they will continue representing money in your account, and will allow you to take money out of your account. Basically, if you have $10,000 in your account, your bank might loan out $2000 of that, so when you withdraw $50, they can still give you money. That $2000 will go out in loans to people who need money for things.

Now you might be wondering why we put our money in institutions that just hand it over to someone else. Well, bank loans aren't just random spends, they're calculated risks. People will loan money from the bank in order to make major purchases which they can pay back over time, for starting or growing businesses, buying homes and cars, and even making important investments. To make sure that this doesn't lead to a loss in the long run, banks will charge interest for the people they loan money to, and pay you interest on the money you deposit back. Interest is essentially a percentage fee that you have on a loan, where you receive back more than what you lent out. For example, if I make a $10 loan with 10% interest to a friend, she'll have to pay me back $11 instead - the original $10, plus a little extra for the security.

There are actually many types of banks - and only one of them work with us. While national banks, like the Federal Reserve in the US, work with a government's policy, and investment banks focus on targeting wealth growth for high net-worth individuals, only commercial banks will actually work with everyday consumers like you and me. Since we're trusting these institutions with our money, the very first thing to consider when choosing a bank is whether or not they have accurate accreditation. This means that they've been certified and guaranteed by the government of your country in the way that they regulate banks. These certifications help ensure that you work with banks that are legit. We also want to make sure that the banks we work with act in our best interest. That's a bank that is transparent about how your money works and where it goes, as well as keeping your bank membership affordable and usable.

Banks from your perspective

While banks complete lots of deeply complex and intricate functions in economies, that's usually not the purview of anyone except financial professionals and economists. As a consumer, your banking is the infrastructure you can use to lead your best financial life - regardless of what you do for work.

At banks, you can open accounts - these are essentially formalized arrangements where you agree to store or use money through the bank in some way. Your money is stored under different types of accounts that can serve different purposes - from daily transactions to long-term savings. How does it work? Well, your income - the money that you make - is stored within those accounts, and come out of those accounts to spend on items. Bank accounts act as storage for money that you can then use to pay for things later on. There are three main types of bank accounts, each with different purposes.

Checking Accounts

Checking accounts are where you store your everyday money - these accounts are the terminal from which you can store and move money into other accounts. Known as a current account in some places, this is essentially where your money will start in your financial infrastructure, before you move it around into other accounts or just spend it directly.

You can directly transfer money from one bank account to another - so you can transfer your paycheck that goes into your checking account into a savings account, for example. Many banks will offer automation services, where you can set up a certain amount of money to be transferred from your account after a set period of time. For example, you might set up an automatic transfer of $500 dollars from your checking account every month for your investments, or $200 dollars for your savings.

The money you spend on a day-to-day basis will also come out of your checking account. This account is connected to your debit card - which is essentially a card that you can use to pay for things that is directly tied to the value of your checking account. You can also withdraw cash, or paper money, from your checking account using ATM (or Automatic Teller Machines), where you can view the balance (or total money you have in the account) and take out money based on that. When you eventually get a credit card, you can pay off any bills you get on the credit card with money from your checking account as well.

While checking accounts allow you to (usually) freely move around money in the account, they often do not pay you interest, so the value of the money in your checking account will stagnate over time, and just be the same.

Savings Accounts

Your savings account, unlike a checking account, is where you store money for the long-term if you want it to appreciate (increase in value) over time. When you store money in a savings account, there's typically restrictions on how much money you take out of the account, but less restrictions on how much you put in. With savings account, the two big players of time and interest can really help you grow the overall value of the money you save up.

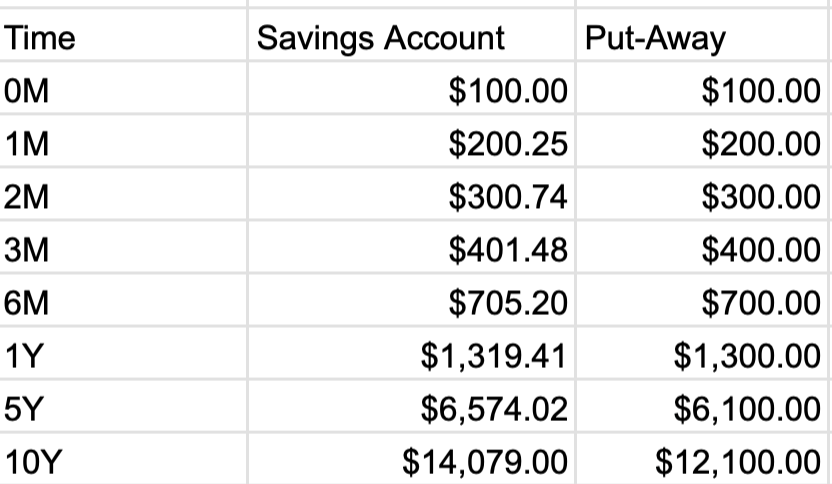

Let's say that you put a deposit, or starting amount, of $100 dollars into a savings account. Then, every month, you put in another 100 dollars. The interest is measured in annual percentage yield (APY), which is a way to measure the interest gathered on a savings account in a year. This account's interest is 3% APY - you'll accrue 3% more than whatever you put in!

Here's what a side-by-side comparison of putting money into a savings account vs. just putting it away and storing it looks like over time:

You usually can't withdraw money from a savings account without having to pay fees or getting a penalty. This prevents you from keeping these appreciating assets in one place and letting time do its job! Some countries even have incentivized savings account that are used for retirement, such as the Roth Individual Retirement Account (IRA), which US Citizens can contribute to until they max it out, after which the money remains for you to use after you retire.

While checking accounts are for current you, your savings account is the foundation for future you. That way, you've now got the infrastructure to use and save your money. Now how can you take that money and grow it into wealth?

Investment Accounts

Investment accounts are specialized accounts that, instead of holding money, hold your securities, or financial products with variable value. When you invest in something - like a stock, for example - you're buying something that might go up in price or go down in price. An investment account allows you and/or a professional to manage these variable items. Investment accounts are the ones by which you can grow your wealth over time. You make deposits into an investment account through a checking account.

Choosing the right bank

Early on in our adult financial lives, we will have very, very little time to think about the way our money works. Many of us will be in university, beginning to start jobs, working part-time, traveling the world, completing internships and engaging in all of those key life milestones. Realistically, you're probably only going to work with one or two banks in your entire college career, maximum. That's why picking the right one for your needs is so important. In general, there are three main things to think about when choosing a bank:

- Size and transparency: Typically, larger banks are seen as more reliable because of how much they have in assets and how less likely they are to accidentally lose your money. With that being said, it's important that a bank is transparent about your financial situation, their operations and the products they offer, and that they empower you to make the best decisions possible for yourself.

- Customer service and good faith: A strong bank for us, leading very busy lives, is one that is responsive with customer service and is receptive to questions. They would be there to support you, not exploit your money

- Value for money: A bank account should be a place for you to store and grow your money, not to lose it. If a bank account has too much in potential overdraft, interest, or fees, it's not worth it.

Beware your Bank Fees

Banks often have built-in safety mechanisms and hidden costs that can put you into financial trouble if you're not careful. It can be easy to lose sight of the overall value of your bank account, especially if you aren't viewing it regularly, and are just tapping your cards instead. Here are some of the common fees that banks will activate:

- Non-sufficient funds: Many accounts (whether checking or savings) will have a minimum monthly balance you need to have. If you fall below this, you might be hit by a non-sufficient funds fee

- Maximum withdrawal fees: These are often preventative and attached to savings and investing accounts, preventing you from taking out too much money without a quick financial penalty

- Overdraft fees: Mainly for checking accounts - if you accidentally spend more money than you actually have, some banks will actually put your bank balance into the negative range, and then turn it into an urgent loan. That means that they will not only charge interest on the negative value, but also take the full value out of the next money that comes into your checking account. For example, if you accidentally have a $10 overdraft with an interest rate of 10%, if you deposit $15 dollars into your account,$11 dollars would be taken away, and your account would then only be worth $4

- ATM and Bank Transfer Fees: When you want to cash out your money or move your money into an account with a different bank, (or vice-versa, in the case of your paycheck) your initial bank might charge a fee for doing so. One way to avoid that fee is to set up direct deposit for common transfers like your paycheck

- Inactivity Fees: If you stop using your bank account for a while, your bank might charge you fees as they still maintain the account, even if you're not really doing anything on it

- Foreign Usage Fees: If you leave the country or territory where you usually use the account, your bank might charge extra on purchases made while traveling or in a foreign country

The actual fees for each bank really depend on the bank you're working with. That's why the most important thing you can do for yourself and your financial infrastructure is to work with bank that is transparent, reputable and attentive to your needs as a consumer.