Episode 3: How do I construct a budget?

A budget is a type of financial plan that you can use to plan how you spend your income in a period of time, to ensure that you can maintain your lifestyle without going into debt, and having enough money for the things you want to do - such as saving up, investing and money for your spending.

Before we actually create a budget, it's important to understand what your individual value of money is. $10 dollars to you might be a very cheap purchase, but to somebody making $20 a week, it's a lot of money! That's because we often use subjective measurements to determine if a purchase is "cheap" or "expensive", in a way that's largely influenced by our early lives. For example, if you grew up in a low-income household, you might see any purchase over $20 dollars as being wasteful or as a luxury, but it would seem ordinary to someone growing up in a high-income household. Different countries, cultures and even parenting-styles all have different perspectives on what money is worth and what to do with it. When we're establishing the flow of money in our own daily life, however, we need more objective measurements of how much "money" is actually worth.

Let's analyze this a bit. If I make the median salary for the UK, approximately £37,000 pounds per year, that means that I'm making approximately £3,080 every month. That means that a £5 Starbucks drink would be worth approximately 0.16% of your income. For Taylor Swift, who made £1.82 billion in 2023 from the Eras Tour, it would be less than 0.0000003% of her monthly income. If we were to go for the same value for money, a $2.8million mansion would be like buying a Starbucks drink for her for the same value for money. That's why it's so important to put into perspective how much you make, and budget for the fact that your value of money will change over time.

When you're in college, potentially working part-time at a minimum-wage job or with your university, your pay will be substantially lower than your entry-level position after graduation, which will be substantially lower than your salary in ten years assuming you are promoted and become more experienced. However, we want to consistently budget and keep an eye on our spending at every level of income, just because it's incredibly easy to spend money on things that don't matter when we feel as though we have a lot of money.

The most important thing about a budget is being aware, not perfect. We construct budgets so we can have a general idea of how much money we are using, and how we can optimize that to ensure that we are spending on what we love now, and ensuring we have enough to spend in the future. Having a budget can help address impulse-buying, reduce anxiety and regret after purchases, and even help you save more and invest more in the long run.

To start creating a budget, we first need to understand units of time - we will incur various costs at different points in our lives, but keeping track of when they happen and in which intervals can help us plan and stay aware of them over time. Here are some basic units of time:

- Daily - how much money you spend every day

- Weekly - how much you spend every 5-7 days

- Monthly - how much you spend every month

- Quarterly - How much you spend every three months

- - how much you spend every six months

- Yearly/Annually - How much you spend every year

Then, we can actually separate our spending into categories - broad types that we spend on, like groceries, eating out, clothes, utilities, etc. That way, we avoid the complexity of traditional budgeting which assigns a specific, limited value to everything from an electricity bill to a t-shirt every week. In your budget, you assign each of them a percentage value based on your income. For example, you might assign 5% of your income to go towards utilities.

You'll probably notice that your categories will fall under various different units of time - you might be the type to spend on clothes or takeout every week, or only occasionally spend on them every month. One of the best things you can do for yourself is to extend the actual spending periods you give yourself, especially for things that are perceived as necessities. For example, you need clothes, they are 100% a necessity, but you don't actually need to buy a new shirt every week or every month. Realistically, you should only be majorly shopping or getting new clothes every three months. Some people who aren't as interested in fashion or don't have the energy to shop for clothes every quarter might even choose to assign "yearly" to the same category. That's natural, since what you spend on is subjective and up to you.

That can make it harder to budget at times, since we cannot assign a single unit of time to all of our spending and use it to plan. With percentage-based budgeting, you can actually determine the unit of time that works best for you. The easiest way to decide on your units of time is to look at when your income comes in. If you receive a paycheck every month, make a monthly percentage-based budget for that paycheck. If you work a part-time job with a weekly paycheck, create a budget for that paycheck! Just remember to make your budget flexible to account for categories that don't fall within that unit of time. For example, if you're working on a weekly budget, mark out the specific weeks where you'll spend money on a broader category like clothes, so you can factor that into your budgeting on those specific weeks.

Those categories will be different for you depending on what your living situation is and who's contributing to your living situation. For example, when you live in a college and your fees are paid for by parents, you don't actually have to budget for things like rent or a meal plan, since those would be covered for you.

Here are some common categories to check for:

- Fixed-cost needs: these are life necessities, like electricity, water and heating that often show up on a monthly bill with a fixed amount. You know exactly how much money they will cost you, so just convert them into a percentage

- Variable-cost needs: these are also life necessities, but the amount you spend on them might change depending on your personal circumstances. This might be your groceries, toiletries, and cleaning products

- Subscriptions: These are usually fixed-costs but aren't exactly life necessities. Subscriptions are essentially when you receive and pay for something regularly. Anything can be a subscription - from your gym membership, to Netflix, to Spotify Premium, to delivered groceries. It's always good practice to restrict the non-essential subscriptions that you have so you can determine how much you're spending on each

- Priorities: This category of spending is your most important one outside of your needs - your financial priorities are essentially the things you pay for regularly that are necessary for you to lead a happy life.Priorities are different for everyone, and are completely dependent on what makes you happy!

- Savings: Savings are essentially money from your income that you can put towards future spending, especially very big spends like buying a house or a car, going on a vacation, buying a new laptop or device, and more!

- Planned Savings are when you're saving up for something you know you're going to spend on, such as a vacation or a down payment

- Unplanned Savings: also known as a nest egg or emergency fund, are a specific amount of money you can put aside for unknown situations like medical expenses or unemployment, that give you the financial leeway for crises and spontaneity

You can put your investments in a HYSA (a High-Yield Savings Account) that will actually also grow your savings over time! See episode 6 for more.

- Investment: We talk more about investing in episode 10, but this is money that you will put into appreciating assets, or things that become more valuable over time, so that they will continually grow. For example, if you invest $20 in a specific stock for a year, you would have invested $240 dollars in that stock. If the value of each stock goes from $10 to $100, you will now have $2400 in investments!

- Wants/Guilt-Free Spending: This is money that you can put towards any expense that isn't an absolute priority or a need. When you need to find a percentage to reduce on your budget, this might be the first thing to reduce

It's important to also understand the difference between priorities and wants. Rather than seeing all spending you do that isn't to keep yourself alive as a "want" and getting rid of it, it's important to note that your mental health and overall happiness is also really important. While money can't exactly get you joy, it can enable you to pursue what brings you joy. For example, if you really enjoy painting as a hobby and spend three hours every day doing it outside your job, a financial priority for you would probably be budgeting in paint, canvas and supply costs. On the flip side, it isn't as useful for you to spend $20 a day on an expensive Acai bowl when you're not actually that much of a fan of Acai.

The way I like to think about priorities vs. wants is the 80-20 rule. This is essentially a principle that says that 20% of the input you put into something will lead to 80% of your output. In the context of your spending, we can think of it as 20% of your actual spending contributing to 80% of your overall quality of life. If we take away the costs of surviving from that 20%, we're actually left with very little of our spending that brings us a lot of long-term happiness, rather than immediate pleasure.

When we talk about financial priorities, we're not talking about one specific thing - like "ah yes I will have a psychotic breakdown if I write with anything except a Pilot G7 0.5 standard black ink" - but a category of spending that's usually associated to something you do. For example, some people will have a really valued hobby that they invest in, or are part of a fandom, or really enjoy a cuisine. That is what you want to factor into your budget and really go heavily on because it's what is going to bring you the most long-term joy. It also means that if something is a priority to you, but doesn't take much out of your income at all, you don't have to really budget that in. If you're a fan of going to the park for walks, other than the cost of maybe washing your clothes a bit more often or having workout clothes, you're not going to be spending much on that at all.

How do you actually tell the difference between a financial priority and a need? It's really subjective, but here are some guiding questions:

- Is it something that I have enjoyed/have wanted to try for more than a year consistently?

- Is it associated to a trend, behavior or pattern that has brought me joy?

- What is the purpose that this has played or will play in my life?

- Would I use the money I spend on this on something else?

Considering these questions can help you outline your financial priorities.

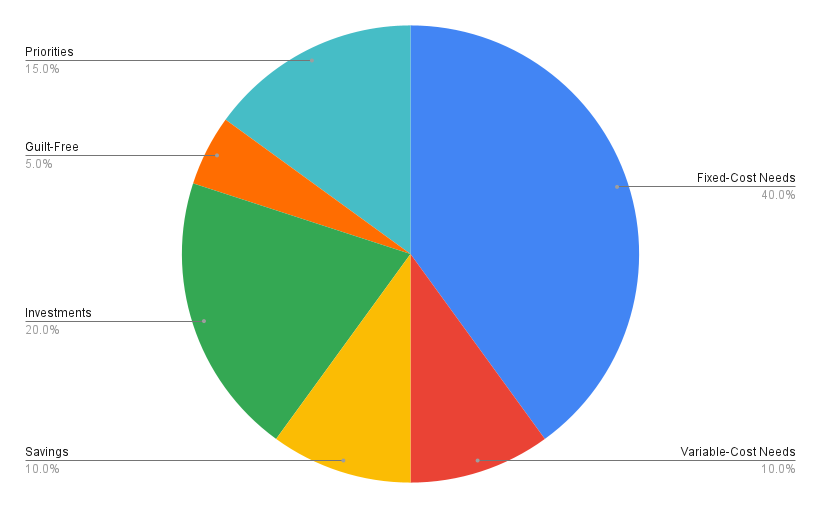

With these categories, all we need to do is assign percentage value to each. We want to maximize our investments, savings and priorities, and optimize everything else. Here's a sample budget for a $3000 monthly income, broken down into fixed needs, variable needs, priorities, savings, investments, and guilt-free:

As you can see, by spending $1500 dollars on needs, $600 on investments and $300 in savings, this individual still has $450 to spend on any of their priorities, and even has $150 for guilt-free spending!

As you grow and evolve into a different person, it's completely natural to change those percentages. If 70% of your paycheck goes just towards your needs, that's okay! Try increasing those other sides, like investing, by just 1% every year and see where it gets you! Especially as the money you make increases, your budget will start looking different. Having this kind of a percentage-based plan in mind helps you stay conscious about how much you have and how much you're spending, setting you up for financial sustainability!